What Changed and Why It Matters

Dell is in talks to acquire Dataloop, an AI data-infrastructure startup, according to CTech by Calcalist. If the deal closes, it would extend Dell’s push from hardware into the data layer of AI.

Why it matters: most enterprise AI slowdowns aren’t GPU-bound. They’re data-bound. Dell has spent the year positioning its AI Data Platform to remove data bottlenecks, optimize GPU throughput, and make on‑prem AI feel cloud‑simple.

“Eliminating data bottlenecks, optimizing GPU performance, and scaling AI.”

That is the pitch from Dell’s own platform materials. The potential Dataloop buy would plug a clear gap: end‑to‑end data lifecycle and orchestration for model training and fine‑tuning.

Here’s the pattern. AI factories need fast, consistent data supply lines. Owning the data plane—not just the racks—decides utilization, cost, and outcomes.

The Actual Move

- Reported development: Dell is in talks to acquire Dataloop, an Israel‑based AI data‑infrastructure company. The potential acquisition would deepen Dell’s enterprise AI stack beyond storage and servers and into data lifecycle software.

- Platform context: Dell launched and expanded its AI Data Platform to unify data discovery, prep, movement, and performance across AI workloads.

Dell says its advancements “break down data silos to unlock deeper business insights and accelerate AI outcomes.”

- Storage backbone: Dell PowerScale delivers NAS simplicity with parallel performance for AI workloads like training and fine‑tuning.

Dell highlights “parallel performance for AI workloads” as a core capability of PowerScale under the AI Data Platform.

- Ecosystem signal: Analysts frame the AI Data Platform as the foundation for Dell’s AI build‑out, emphasizing an open, modular, GPU‑optimized approach aimed at on‑prem AI data centers.

- Integration breadcrumbs: Industry posts describe how Dataloop’s software already integrates with Dell’s AI Data Platform, enabling data discovery, transformation, and lifecycle simplification.

“Not only enables data discovery and transformation but also simplifies the entire data lifecycle.”

Taken together, Dell is moving from hardware‑led AI to data‑led AI. Dataloop looks like the missing layer that productizes the messy middle: collecting, curating, labeling, transforming, versioning, and routing data into model pipelines—at enterprise scale.

The Why Behind the Move

Zoom out. This is a classic “own the bottleneck” play.

• Model

Dell monetizes infrastructure. The AI Data Platform adds software leverage. A Dataloop‑like layer moves Dell upstream into recurring data ops, creating stickier ARR tied to ongoing training and fine‑tuning, not just initial hardware refreshes.

• Traction

Analysts describe Dell’s platform as the foundation for its AI stack. Customer stories focus on breaking silos and feeding GPUs efficiently. Adding a mature data lifecycle product aligns with that traction and simplifies enterprise rollouts.

• Valuation / Funding

Terms aren’t disclosed. The report notes “talks,” not a closed deal. Expect pricing to reflect strategic value more than pure revenue multiples, given the lock‑in potential across Dell’s installed base.

• Distribution

Distribution is Dell’s edge. A data‑lifecycle layer riding Dell’s global channel and services would scale faster than a standalone ISV. It also integrates cleanly with Dell ProSupport, consulting, and reference architectures.

• Partnerships & Ecosystem Fit

Analyst takes emphasize an open, modular, GPU‑optimized design—an on‑prem alternative to cloud‑native AI stacks.

“By keeping data infrastructure open, modular, and GPU‑optimized, Dell offers an on‑prem alternative to cloud‑native AI.”

Dataloop fits as a neutral data ops layer that orchestrates across Dell storage, networking, and accelerators without locking customers to a single model vendor.

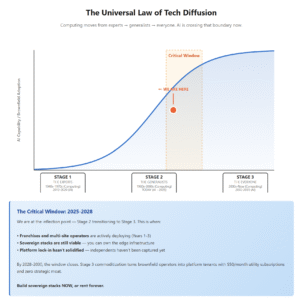

• Timing

Enterprises are moving from pilots to production. GPU scarcity is easing; data bottlenecks are now the limiter. A streamlined data plane yields immediate ROI: higher GPU utilization, lower data prep time, faster iteration.

• Competitive Dynamics

- Hyperscalers push managed AI data stacks (AWS, Azure, GCP).

- Databricks and Snowflake battle over the analytics‑to‑AI data plane.

- MLOps/data labeling players (e.g., Scale AI, Labelbox) focus on subsets of the lifecycle.

Dell aims to differentiate on sovereign/on‑prem control, end‑to‑end performance, and integrated ops—from PowerScale storage to data lifecycle to training.

• Strategic Risks

- Integration complexity: stitching Dataloop into Dell’s platform and services without adding friction.

- Ecosystem neutrality: acquiring a partner can spook other ISVs who prefer vendor‑agnostic stacks.

- Change management: data lifecycle tooling touches people, process, and policy—not just tech.

- Focus drift: platform breadth can dilute the clarity of Dell’s core value proposition.

What Builders Should Notice

- Own the bottleneck. In AI, the bottleneck moved from GPUs to data. Follow it.

- Distribution beats point features. A good product plus a great channel wins.

- On‑prem is back. Sovereign, secure, and cost‑predictable AI is a real market.

- Integrations are strategy. “Works with” today becomes “we own it” tomorrow.

- Platform clarity matters. Remove steps between raw data and model output.

Buildloop reflection

Every AI edge starts in the data plane. Control the flow, control the outcome.

Sources

- CTech by Calcalist — Dell in talks to acquire AI data-infrastructure startup Dataloop

- Dell Technologies Blog — Break Through AI with Data

- Dell Technologies Investor Relations — Dell AI Data Platform Advancements Unlock the Power of …

- AnalystANGLE (YouTube) — Dell AI Data Platform Event – AnalystANGLE

- LinkedIn — How Dataloop software integrates with Dell AI Data Platform

- Dell Technologies Newsroom — Dell AI Data Platform Advancements Unlock the Power of …

- Medium — Dell’s AI Data Platform Event: Does It Reinforce … – Mark Vena

- Dell Technologies (YouTube) — Unlock the Power of Data with Dell’s AI Data Platform

- Klover.ai — Dell’s AI Strategy: Analysis of Dominance in Computer …

- theCUBE Research — Dell AI Data Platform: Building the Foundation for Agentic AI