What Changed and Why It Matters

Apple is reportedly acquiring Q.ai for about $2 billion. The move signals a deeper shift to on‑device AI across iPhone, Mac, and potentially new form factors.

On‑device inference is not a side bet. It’s a cost, latency, and privacy strategy bundled into one. As one report put it:

“Running neural networks on‑device is more cost-efficient than hosting them in the cloud, which could help Apple drive down the cost of …”

Here’s the part most people miss: Apple’s advantage isn’t cloud scale. It’s a hardware moat built over a decade of silicon, secure enclaves, and distribution. As another analysis notes:

“Apple’s approach is not about buying as many AI chips as possible; it is about leveraging its existing hardware moat.”

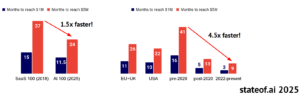

Zoom out and the pattern becomes obvious. Apple’s spend with TSMC multiplied from billions to tens of billions as its silicon ambition scaled.

“Apple’s annual spend at TSMC grew from $2B in 2014 to $24B in 2025. That is 12x …”

The signal: Apple is consolidating AI into devices, not data centers. That keeps experiences fast, private, and margin‑friendly—and forces hard product choices.

The Actual Move

- Acquisition: Reports say Apple is buying Q.ai for roughly $2 billion, with some coverage describing it as an Israeli startup. The goal: accelerate on‑device AI capabilities.

- Platform posture: Apple is pushing inference on the edge to cut cloud costs and protect privacy.

- Silicon pipeline: The TSMC partnership underwrites more advanced NPUs and packaging at massive scale.

- Product signals: Apple reportedly explored an AI‑reshuffled iPhone home screen—and rejected it for usability.

- New form factors: Apple is also reportedly developing a thin, AI‑powered wearable pin.

- Market reaction: Investors and operators see upside in monetization and platform stickiness, even as leadership stays vague on near‑term revenue.

Selected commentary from the ecosystem:

“Bottom line: a near-$2bn AI acquisition by Apple signals heavier on-device investment across its hardware line.”

“Cook’s fumble reveals that even the most valuable company in the world is winging it when it comes to AI economics.”

“Your key comments are spot on: ‘AI capabilities demand more sophisticated silicon manufacturing; Apple can afford $2B in R&D.’”

“Apple flirted with letting AI reshuffle your iPhone apps. In the end, it was decided that muscle memory mattered more.”

The Why Behind the Move

• Model

On‑device inference slashes variable cloud costs, reduces latency, and keeps data local. That aligns with Apple’s privacy posture and gross margin discipline.

• Traction

Apple’s install base is the distribution engine. AI features ship via iOS and macOS, not URLs. Adoption is a software update, not a signup form.

• Valuation / Funding

A $2B check is small relative to Apple’s cash flow. If it de‑risks cloud costs and accelerates silicon leverage, the ROI compounds across product lines.

• Distribution

OS‑level placement ensures usage. Siri, camera, and system apps are default touchpoints. That beats app‑store discovery every time.

• Partnerships & Ecosystem Fit

TSMC remains core. Advanced packaging and NPU capacity turn model innovation into user‑ready features at scale.

• Timing

Edge compute is catching up. NPUs are improving, memory is denser, and quantization methods are more practical for phones and laptops.

• Competitive Dynamics

While others chase cloud‑AI scale, Apple optimizes for device economics and UX reliability. Different game, different scoreboard.

• Strategic Risks

Monetization is still murky.

“Cook’s fumble reveals that even the most valuable company in the world is winging it when it comes to AI economics.”

There’s also execution risk: hardware lead times, model performance on constrained devices, and preserving UX habits.

What Builders Should Notice

- On‑device economics are a moat when you control distribution.

- UX discipline beats novelty. Don’t break muscle memory for “AI magic.”

- Hardware–software co‑design compounds. Align model choices with silicon.

- Monetization can lag strategy. Own the platform first, then price the value.

- Partnerships are leverage. The right foundry or infra partner multiplies speed.

Buildloop reflection

Moats aren’t models. They’re where the model runs.

Sources

- SiliconANGLE — Apple acquires AI startup Q.ai for reported $2B

- AInvest — Apple’s AI Strategy: A Structural Advantage Endures

- Reddit — APPLE ACQUIRES AI STARTUP Q.AI FOR $2 BILLION

- Complete AI Training — Apple buys Israeli start-up Q.AI for nearly $2bn as AI device …

- TechBuzz.ai — Apple’s Tim Cook Dodges AI Monetization Question

- SemiAnalysis — Apple-TSMC: The Partnership That Built Modern …

- QuiverQuant — Apple Inc. Stock (AAPL) Opinions on AI Partnership and …

- LinkedIn — How Apple’s $2K iPhone reveals advanced manufacturing …

- Sherwood News — Apple is reportedly working on a wearable AI pin

- eWeek — Why Apple Considered an AI Home Screen for the iPhone