What Changed and Why It Matters

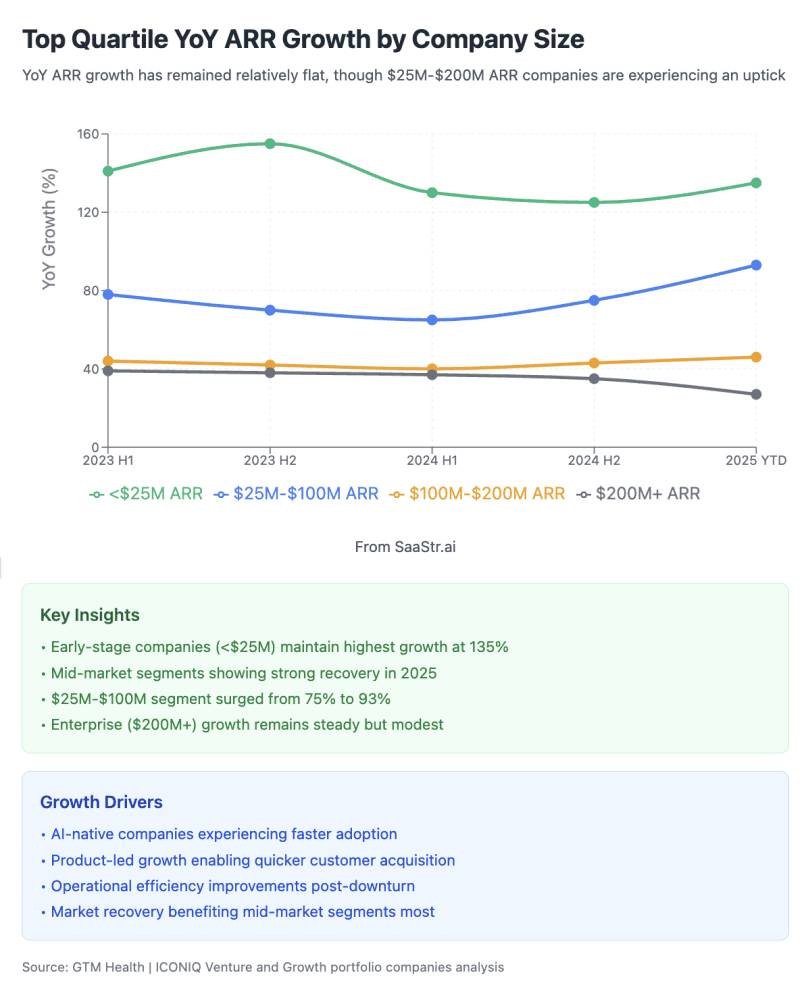

ICONIQ’s latest B2B SaaS readout puts a spotlight on where growth actually breaks loose. Mid-stage companies in the $25M–$100M ARR band are finally pushing past the “growth plateau,” and the common thread isn’t more leads — it’s better mid‑funnel execution.

“The Mid-Stage Breakout: Companies in the $25M-$100M ARR range are finally breaking free from what many call the ‘growth plateau.’” — SaaStr on ICONIQ’s 2025 findings

At the same time, operators are openly debating which AI levers move revenue fastest under $25M ARR — adoption nudges, usage-based pricing, or leaner sales motions. Case studies back it up: teams that fixed activation, qualification, and sales-assist saw step-change results without adding headcount.

Zoom out and the pattern becomes obvious: 2025 is the year GTM shifts from top-of-funnel obsession to mid‑funnel mastery — activation, expansion, and pricing — measured against efficiency metrics that boards understand.

The Actual Move

Across the ecosystem, the concrete moves are consistent:

- ICONIQ codifies a durability lens with the Enterprise Five — a framework of five core metrics representing long-term growth and efficiency. Teams are steering to these dials, not vanity leads.

- SaaStr’s coverage of ICONIQ’s 2025 GTM report highlights the breakout of $25M–$100M ARR companies, signaling process, pricing, and expansion are paying off.

- Operators are prioritizing AI in the mid‑funnel: onboarding nudges, product-qualified pipelines, usage-based pricing, and sales-assist — as surfaced in ICONIQ-linked operator discussions.

- A healthcare GTM transformation (GTM Partners) shows that fixing routing, qualification, and enablement can drive tens of millions in new revenue in months — without a new top-of-funnel engine.

- BlueJ’s decade-long journey from supervised ML to an LLM-powered tax research product correlates with ARR compounding from $2M to $25M — a product evolution that directly improves activation and time-to-value.

- Remofirst raises $25M after 10x ARR growth since 2022, competing with Deel and Rippling by sharpening segment focus and GTM efficiency.

- The funding tape is noisy — from climate tech like Rainmaker’s $25M Series A to eye-popping AI valuations debated on Hacker News — but the durable operators are redeploying capital into activation, expansion, and efficient payback.

- Tomasz Tunguz’s ongoing data work reinforces the playbook: spending to grow looks different across SMB, mid-market, and enterprise — and the best performers match spend to segment with tight payback windows.

Here’s the part most people miss: the wins compound in the middle — not at the top. AI is finally good enough to guide users, score intent, and coach reps in flow. That’s where the revenue unlocks.

The Why Behind the Move

• Model

AI-native GTM focuses on activation and expansion: product-qualified activities, AI scoring, onboarding nudges, and sales-assist. These compress CAC and shorten payback compared to lead-heavy funnels.

• Traction

ICONIQ’s mid-stage breakout points to process repeatability: consistent activation, expansion, and pricing beats sporadic top-of-funnel spikes.

• Valuation / Funding

Remofirst’s raise after 10x ARR growth shows efficiency attracts capital. On the other end, headline valuations (like the “Thinking Machines” chatter) highlight froth — but boards still underwrite efficient growth over noise.

• Distribution

The moat isn’t the model — it’s distribution. Usage-based pricing, high-NDR packages, and PLS motions win when tied to clear activation paths and sales-assist.

• Partnerships & Ecosystem Fit

GTM gains come from where your product lives: CRM, support, docs, and the product itself. AI copilots are most valuable when they sit inside workflows, not portals.

• Timing

Budgets in 2025 are growth-minded but efficiency-enforced. The ICONIQ Enterprise Five gives operators a shared language with finance, accelerating decisions on pricing, packaging, and retention bets.

• Competitive Dynamics

In crowded categories (EOR vs. Deel/Rippling), segmentation, geo/package focus, and service-layer differentiation matter more than feature parity. AI should sharpen ICP, not broaden it.

• Strategic Risks

- Over-automation that hurts trust and conversion

- LLM brittleness in high-stakes workflows (e.g., legal, tax)

- Chasing metric optics (NDR, payback) at the expense of user value

- Dependence on third-party model costs that erode margin if usage spikes

What Builders Should Notice

- Move the bottleneck: invest in activation and expansion before more leads.

- Price what users repeatedly do, not what finance hopes they’ll do.

- AI belongs in the workflow. Coach users and reps in the moment of work.

- Instrument the Enterprise Five-style dials. Report them weekly.

- Segment ruthlessly; tune funnel, pricing, and sales-assist by segment.

Buildloop reflection

Every durable curve bends in the middle — activate first, then scale.

Sources

- SaaStr — GTM in The Age of AI: The Top 10 Learnings from ICONIQ’s 2025 B2B SaaS Report

- ICONIQ Capital — The ICONIQ Enterprise Five

- LinkedIn — The State of Go-to-Market in 2025 – ICONIQ | Ivan Landabaso

- PMF — How to Build a Legal AI Company: The 10-Year Journey from Professor to $25M ARR

- First Round — Levels of PMF

- GTM Partners (Substack) — From Survival Mode to $84.8M in 8 Months (Step-by-step)

- dot.LA — This LA Startup Wants to Make It Rain and Just Raised $25 Million

- TechCrunch — Remofirst raises $25M to take on Deel and Rippling in the global EOR market

- Hacker News — Mira Murati’s AI startup Thinking Machines valued at $12B (discussion)

- Tomasz Tunguz — Tomasz Tunguz | Blog