What Changed and Why It Matters

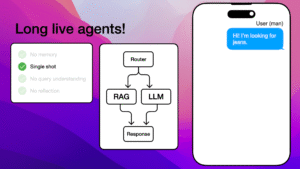

China’s AI market just picked its next arena: agents that act, not chat.

Startups and tech giants are racing to build mobile-first agents that can operate apps, complete tasks, and drive real outcomes. Media across China and the US now frame agents as the next competitive front—spanning smartphones, cars, and embodied systems.

Here’s the shift: instead of “talk-to-a-bot,” China is pushing “tell it what you want, and it gets it done.” That’s a product moat built on distribution and integrations, not just bigger models.

Most people focus on model quality. The real moat is control over actions.

The Actual Move

From the recent coverage, several concrete moves stand out:

- A mobile agent boom. Reporting points to a surge of China-first agent apps that operate across multiple mobile apps, reflecting the country’s super-app DNA. MIT Technology Review notes a wave kick-started by Manus, catalyzing copycats and competitors.

- China’s giants pivot to spatial and embodied intelligence. South China Morning Post reports Tencent is investing in “world models” to give agents spatial understanding—key for robots, AR, and complex real-world tasks.

- Auto becomes the next agent surface. 36Kr highlights that AI has overtaken the “three electric systems” as the new battleground in cars. Think in-vehicle copilots that handle navigation, commerce, support, and maintenance workflows.

- Compute-efficiency as a strategy. Nikkei Asia cites Alibaba’s claim that its latest Qwen3 series needs significantly less compute, aligning with export constraints and the push for on-device or low-cost agent runtimes.

- China vs. US race intensifies. Caixin Global, Rest of World, KrASIA, and others depict a split: US players double down on API-driven and desktop/browser agents, while China’s advantage skews to mobile execution across super-app ecosystems.

- Agent revenue is real, not theoretical. Industry digests (AI Agent Store) flag growing revenue expectations from agentic systems, supporting the shift from LLM demos to automation P&Ls.

Agents are apps that turn thoughts into outcomes. The shift is from “answers” to “actions.”

The Why Behind the Move

Zoom out and the pattern becomes obvious: China’s strengths—mobile distribution, super-app ecosystems, OEM partnerships, and speed—map directly onto agentic products.

• Model

- China’s players emphasize efficient LLMs (e.g., Alibaba’s Qwen3 claims lower compute) and hybrid stacks that blend LLMs with tools, memory, and UI control.

- Tencent’s bet on world models suggests a long play: embodied agents that understand space, scenes, and causality.

• Traction

- Manus helped kick off a broader wave of mobile agents that can operate other apps—aligned with China’s all-in-one, super-app tradition.

- Rest of World and MIT Technology Review describe a market tilting from chat interfaces to task completion across the phone.

• Valuation / Funding

- While granular rounds aren’t highlighted across sources, the coverage signals significant internal investment from China’s tech giants and fast capital formation around agent orchestration startups.

• Distribution

- China’s path to distribution runs through WeChat, handset OEMs, and vertical super-apps (commerce, finance, mobility).

- In contrast, US agents often rely on browser + API integrations. China’s agents frequently control real apps directly when APIs are missing.

• Partnerships & Ecosystem Fit

- Partnerships with handset makers and car OEMs can grant deeper system permissions, latency budgets, and privileged integrations.

- Tooling and orchestration layers—planning, memory, UI automation—are becoming as strategic as the base model.

• Timing

- LLM costs are falling; agent frameworks are stabilizing. China’s export-constrained compute environment rewards efficient, on-device, and hybrid approaches.

- Consumer expectations are shifting from “converse with AI” to “delegate to AI.”

• Competitive Dynamics

- US: heavy investment in frontier models and API-rich ecosystems.

- China: bias to execution, mobile-first agents, and integrated experiences that look like super-apps on steroids.

- Auto and “embodied” categories are new frontiers where world models and sensor fusion matter.

• Strategic Risks

- Platform policy headwinds: OS-level restrictions on accessibility, automation, and in-app control can change quickly.

- Reliability: success rate, latency, and error recovery are make-or-break.

- Safety and compliance: agents making payments or controlling vehicles face higher regulatory scrutiny.

- Trust: cross-app control demands strong permissioning, logging, and user safeguards.

The moat isn’t the model—it’s the distribution surface plus reliable execution.

What Builders Should Notice

- Build for actions, not answers. Ship task success, not token stats.

- Own a surface. Phone, car, or enterprise workflow—deep integration beats broad novelty.

- Design for reliability. Measure end-to-end success rate, not just accuracy.

- Partner early. OEMs, super-apps, and tool providers compound your moat.

- Optimize for efficiency. Lower compute and on-device paths unlock distribution in constrained markets.

Buildloop reflection

Every durable moat starts as a distribution edge paired with reliable outcomes.

Sources

- Caixin Global — In Depth: AI Agents Trigger the Next Tech Battlefield in China

- South China Morning Post — Tencent expands into AI ‘world models’ as tech giants chase spatial intelligence

- 36Kr Global — AI Overtakes “Three Electric Systems” as New Battleground …

- Forbes — The Next AI Battleground: Why China’s Manus Could Leapfrog Western Agent Technology

- KrASIA — US versus China: Who’s leading the race to make AI agents a reality

- MIT Technology Review — Manus has kick-started an AI agent boom in China

- Nikkei Asia — US vs China: Who’s leading the race to make AI agents a reality

- Folio3.ai — China Advances in AI Agent Competition as Tech Giants Challenge US

- AI Agent Store — Daily AI Agent News – July 2025

- Rest of World — China’s AI agents take on OpenAI in global automation race