What Changed and Why It Matters

Houston is quietly pivoting from energy capital to applied AI capital for heavy industry. The city’s edge comes from deep industrial clusters, cheap and scalable power, logistics, and a workforce built for operations.

Brookings research flags Houston as a top hub for AI growth. Local analysts say the region’s advantage is cross‑industry adoption over pure research. That means faster deployment and revenue for AI tied to real assets.

“Houston’s comparative advantage as an AI hub resides in its strong industry clusters where AI is already reshaping productivity.”

“Houston identified as a top AI hub in Brookings ‘Mapping the A.I. Economy’ report.”

Here’s the part most people miss. Houston’s AI story isn’t model-first. It’s infrastructure-first: energy, manufacturing, and data centers that make AI deployment feasible at scale.

The Actual Move

Several signals point to an applied AI inflection:

- AI in oil and gas is maturing. A 2024 report cites Houston as an emerging hub in a $6B global O&G AI market. Operators are scaling data use, automation, and efficiency systems across the value chain.

- Industrial real estate is shifting. Brokers report “AI factories” moving beyond logistics footprints. Facilities now need power density, cooling, secure connectivity, and proximity to talent.

- Data center capacity is becoming strategy. Local leaders are convening investors, operators, and policymakers around an AI‑driven data center boom in the region.

- Advanced manufacturing is accelerating. Regional narratives highlight a manufacturing renaissance tied to AI and digital production. Reports suggest potential AI-focused plants from major tech firms could reshape jobs and supply chains.

- Independent experts back the momentum. Analysts emphasize Houston’s cross‑industry adoption, energy talent, and partnerships as the engine of growth—more than headline research output.

“As demand for AI and digital technologies grows, Houston is where companies come to build the future.”

“The arrival of AI factories is more than a new tenant story. It’s a new chapter for Houston’s industrial market.”

“New AI plants could create thousands of Houston jobs and reshape the city’s economy, but workforce and supply chain constraints matter.”

The Why Behind the Move

Founders should read Houston’s AI push through an operational lens.

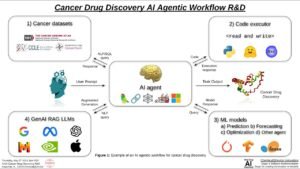

• Model

Houston rewards applied AI: perception, forecasting, optimization, and control systems that reduce downtime, waste, and risk. Think predictive maintenance, computer vision for safety, LLMs for field ops, and digital twins for planning.

• Traction

Adoption happens through existing workflows—plants, rigs, warehouses, and grids. Wins compound where telemetry, SCADA, and EAM systems already exist.

• Valuation / Funding

Growth is driven by enterprise budgets, infrastructure investment, and public incentives—not consumer virality. Revenue durability and contracts matter more than DAUs.

• Distribution

Channels run through EPCs, industrial OEMs, ISVs, and systems integrators. Selling into one operator can unlock dozens of sites.

• Partnerships & Ecosystem Fit

Houston’s advantage is density: energy majors, service providers, port logistics, and universities. Pair AI with utilities, data center operators, and OEMs to move faster.

• Timing

AI’s power appetite pushes capacity to Texas. Houston combines transmission access, industrial land, and maritime logistics. The region’s data center buildout is a tailwind.

• Competitive Dynamics

Competes with Austin, Dallas, Phoenix, and Atlanta. Houston’s differentiator is heavy industry scale and OT talent, not just software talent.

• Strategic Risks

Power availability and interconnection queues, specialized workforce gaps, safety and compliance, long sales cycles, and integration with legacy OT/IT stacks. Policy and community considerations around energy intensity and land use also apply.

What Builders Should Notice

- Go where the power and assets are. AI follows electrons and equipment, not slides.

- Distribution beats novelty. Partner with EPCs, OEMs, and integrators to scale.

- Own the data exhaust. Instrumentation plus domain context is the moat.

- Design for OT realities. Safety, uptime, and compliance decide deployment.

- Build operator copilots, not dashboards. Reduce cognitive load at the edge.

Buildloop reflection

“The next great AI companies won’t start in the cloud. They’ll start on the shop floor.”

Sources

Heartland Forward — Houston’s Position in the AI Cluster Race

Greater Houston Partnership — Houston’s Manufacturing Renaissance: Why Tech Giants Are Betting Big on the Bayou City

KHOU — Houston ranks as Star Hub for AI growth, report finds

Lee & Associates Houston — How AI Manufacturing Is Redefining Houston’s Industrial Landscape

Houston InnovationMap — Houston rises as emerging hub for global AI in O&G industry

YouTube — What’s Houston’s role in developing AI in the oil and gas industry?

Houston Business Journal — AI experts highlight Houston’s potential beyond Brookings report

LinkedIn — How Houston is becoming a high-tech manufacturing hub

Greater Houston Partnership — Houston’s AI-Driven Data Center Boom: Investment, Innovation, and Policy

Houston Chronicle — Apple, Nvidia factories may make Houston an AI manufacturing hub