What Changed and Why It Matters

European venture activity is refocusing on AI-heavy verticals with real distribution: healthtech, security, and design. Corporate buyers and governments aren’t waiting for IPOs — they’re showing up earlier in the cap table and as anchor customers.

This is the shift: AI imaging and its adjacent layers (security, compliance, cloud, and tooling) are pulling in strategic capital across Europe. LinkedIn deal notes highlight ongoing momentum in fintech, AI, healthtech, and climatetech. Bond Capital’s AI Trends underscores a simple truth: compute, data, and workflow integration now decide winners.

Here’s the part most people miss: the new capital isn’t passive. It’s buyer-led. Clouds, pharma, CISOs, and platforms are quietly pre-wiring distribution while the tech matures.

Distribution-first capital is now the strongest accelerant for applied AI in Europe.

The Actual Move

- Flagship Pioneering staked $50M to spin up Expedition Medicines, aiming AI at cancer and immune-driven disease — a bet that leans heavily on multimodal data, including imaging-rich oncology workflows.

- Alphabet surged on a NATO cloud win and the Gemini 3 launch — a signal that sovereign buyers are locking in AI-capable clouds that power imaging and other GPU-heavy workloads.

- AI compliance startup Delve raised a $32M Series A at a $300M valuation led by Insight Partners, with Fortune 500 CISOs participating — strengthening the governance layer that sensitive imaging and clinical AI need.

- Figma acquired Weavy, folding generative AI and pro editing into a shared canvas — a move that normalizes AI visual tooling for enterprise teams (and the downstream imaging stack).

- European VC update threads show continued deal activity in AI, healthtech, and climatetech — categories where imaging, model evaluation, and workflow integration sit at the core.

- Security appetite remains robust (recall Snyk’s $300M raise; historical, but directionally important) as enterprises connect AI services to production data.

Zoom out and the pattern becomes obvious: strategics are piling into the imaging-enabled AI workflow — from cloud and compliance to the last-mile tools creatives and clinicians use daily.

The “round number” to watch isn’t just the check size — it’s the buyer footprint attached to it.

The Why Behind the Move

Founders should read this as a distribution play more than a funding trend.

• Model

Multimodal is standard. Imaging models are only as valuable as their integration with tabular, text, and workflow context. Expect partnerships that tether models to domain data (oncology, radiology, design systems).

• Traction

Customers want outcome guarantees, not demos. Deals are concentrating where AI touches regulated decisions (diagnostics, compliance, security) or high-frequency visual work (design, documentation).

• Valuation / Funding

Rounds and valuations cluster around milestones where distribution risk collapses — e.g., CISOs on the cap table, a NATO-class cloud buyer, or pharma development partners. That’s why you see $30–50M checks tiptoe alongside $300M-scale signals.

• Distribution

The moat isn’t the model — it’s the route to buyers. Cloud contracts, partner marketplaces, and embedded canvases (Figma, EHRs, PACS) now decide velocity.

• Partnerships & Ecosystem Fit

- Clouds: GPU capacity + sovereign compliance posture.

- Pharma/health systems: data, labels, trials, and reimbursement pathways.

- Security/compliance: auditability, policy, and traceability across the imaging pipeline.

- Design platforms: daily active surfaces where visual AI earns trust.

• Timing

Two forces converged: enterprises must show AI ROI in 2025 planning, and regulators are defining guardrails. Capital is moving where both can be satisfied quickly.

• Competitive Dynamics

Horizontal foundation models are commoditizing. The edge is vertical integration: model + data rights + workflow + compliance + distribution. Those who control two or more layers win.

• Strategic Risks

- Data provenance and licensing for clinical and creative datasets

- Overreliance on a single cloud or GPU vendor

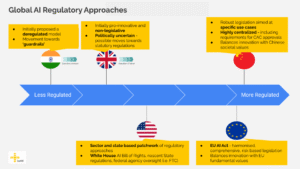

- Regulatory drift between EU/UK/US regimes

- “Demo-ware” that doesn’t harden into reimbursable, auditable workflows

The moat isn’t scale alone — it’s controllable distribution with defensible data rights.

What Builders Should Notice

- Treat distribution as a product surface. Secure cloud, platform, and clinical embeds early.

- Compliance is a feature, not a tax. Build audit trails into the imaging pipeline by default.

- Win on workflow, not benchmarks. Ship where decisions and reimbursements happen.

- Strategics de-risk go-to-market. Invite buyers into the round if they shorten adoption.

- Multimodal > single-modal. Fuse imaging with text, labs, and context to drive outcomes.

Buildloop reflection

Every durable AI moat starts as a boring distribution decision that compounds.

Sources

- LinkedIn — European VC Update: Trends and Deals | Josef Fuss …

- BioPharma Dive — Flagship bets again on AI with Expedition

- Aloa — 15 AI Companies on the Rise Reshaping Enterprise Tech …

- That Was The Week — The AI Gold Rush – by Keith Teare – That Was The Week

- Bond Capital — Trends – Artificial Intelligence (AI) – Bond Capital

- Venture Chronicles — Venture Chronicles – October 2025

- Exec Sum — A Rare Win for Banks

- Techmeme — AI compliance startup Delve raised a $32M Series A at …

- TechCrunch — Snyk raises $300 million at a $4.7 billion valuation as …

- Proactive Investors — Alphabet ‘newly-appointed AI winner’ after shares jump on …