What Changed and Why It Matters

A clear funding pattern is emerging. $50M has become the default ticket for applied visual AI: video generation, robotics vision, and AI-native creation tools.

This is not about one model. It’s about where AI meets users and workflows. Investors are now backing teams who can turn pixels into products, and products into distribution.

“PixVerse proves AI video can be profitable. It’s hit US$50 million in ARR and has nearly 1 million users.”

Video AI isn’t just a demo anymore. Robotics vision is spinning out into focused companies. AI-first UX is rebuilding workflows from scratch. The signal: capital is chasing visual interfaces with real usage and clear go-to-market.

The Actual Move

Here’s the cross-industry shift, company by company:

- Higgsfield.ai raised a $50M Series A to push “click-to-video” for social. The company calls itself an “AI-native video reasoning engine.”

“Higgsfield.ai… announced a $50 million Series A financing… to propel ‘click-to-video’ AI for social media.”

- Intel is spinning out RealSense into a dedicated AI robotics and biometrics company, alongside a $50M funding round. Vision hardware and software are getting a focused P&L.

“Intel said it is spinning out its artificial intelligence robotics and biometric venture RealSense and announced a $50 million funding round.”

- Gamma rebuilt its product around AI in three months, reframing presentations from a formatting task to a generation and iteration workflow. The pivot is positioned as a new strategic moat.

“Rebuilt the entire platform around AI in three months, transforming presentations from a ‘formatting problem.’”

- PixVerse hit $50M ARR and ~1M users, showing AI video can monetize at scale before frontier models reach the market.

- WisdomAI raised $50M to speed analytics with context and trust. The focus is SME-ready AI data tooling.

“Betting on context and trust in AI… tailored to small and medium-sized enterprises.”

- Goodfire announced a $50M Series A led by Menlo Ventures with Lightspeed participating, positioned to advance its AI platform.

- ROLLER secured $50M to inject AI into venue and attractions operations. Frontline software is getting AI-native upgrades.

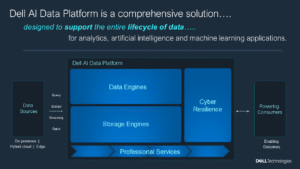

- A new AI stack venture raised a $50M seed backed by Microsoft, Nvidia, Databricks, and Snowflake, signaling deep alignment with the data and cloud ecosystem.

The Why Behind the Move

Zoom out and the pattern becomes obvious. The $50M round is funding go-to-market for visual AI—where models meet distribution.

• Model

Most players aren’t chasing frontier models. They are packaging capable vision and video generation into tight UX and workflows. Robotics vision leans on proven depth and perception stacks.

• Traction

PixVerse’s $50M ARR is the proof point. AI video can pay its own way when distribution is native to social and creator economies.

• Valuation / Funding

$50M is now a scaling round for applied AI. It buys data pipelines, inference optimization, and distribution. For hardware-adjacent vision, it funds focus and independence.

• Distribution

The moat isn’t the model—it’s distribution. Gamma rebuilt UX around AI to increase creation velocity. Higgsfield targets social-native workflows. ROLLER brings AI into daily venue operations. WisdomAI rides existing analytics demand.

• Partnerships & Ecosystem Fit

Backers like Microsoft, Nvidia, Databricks, and Snowflake point to tight ecosystem alignment—compute, data, and enterprise channels. RealSense’s spinout clarifies partnerships across robotics and biometrics.

• Timing

Two forces converge now: video models are “good enough” for consumer-grade content, and enterprises are ready to pilot AI in core operations. The cost curve for inference is improving, making video and perception more viable.

• Competitive Dynamics

Sora-scale R&D captures mindshare, but smaller, focused players are capturing users and revenue. Being earlier to distribution beats being later with a slightly better model.

• Strategic Risks

- Unit economics if inference costs spike or content moderation hardens.

- Platform risk from upstream model providers and app store policies.

- Commoditization of baseline video quality; differentiation must move to workflow, data, and brand.

- Robotics vision faces integration risk and long enterprise cycles.

What Builders Should Notice

- Distribution is the moat. Ship where users already create and share.

- Workflow > wow factor. Make the “everyday edit” 10x faster, not just the demo.

- Speed compounds. Gamma’s three-month rebuild reframed the category.

- Trust and context sell into SMEs. Data lineage and control matter.

- Hardware spinouts signal focus. Vision stacks need dedicated GTM and partners.

Buildloop reflection

“The future of visual AI won’t be won by the best model—it’ll be won by the fastest distribution into real workflows.”

Sources

- LinkedIn — $50M AI Bet on Operations; XR Goes Mainstream

- Substack — How Gamma Pivoted To Build A New $50M AI Strategic Moat

- CNBC — Intel spins out AI robotics company RealSense with $50 million funding

- Goodfire AI Blog — Announcing Our $50M Series A to Advance …

- PR Newswire — Higgsfield Announces $50M Series A to Propel “Click-to-Video” AI for Social Media

- Alejandro Cremades — Stefano Ermon On Raising $50 Million To Enable …

- SiliconANGLE — AI analytics startup WisdomAI nabs $50M investment

- Tech in Asia — The quiet AI video platform chasing $50m before Sora 2

- LinkedIn — WisdomAI raises $50M, betting on context and trust in AI