What Changed and Why It Matters

Nigeria is moving from colocation growth to AI-grade compute. Capital is piling into data centers. Policymakers are putting accelerated computing on the national agenda. Infra vendors are telling operators to upgrade for GPUs.

“Nigeria is positioning itself to lead Africa’s next technological leap, powered by the hardware that fuels AI: GPUs.”

The signal is consistent across sources. Bloomberg reports a billion-dollar race into new facilities. Policy documents call for “modern data centres with accelerated computing.” Schneider Electric is warning operators to retrofit for AI. Independent analysts note that Nigeria’s decade-long colo buildout set the stage.

Why now? Demand is exploding. A young, online population is driving data creation. AI tooling is getting cheaper and more accessible. And the world is looking for new places to train and serve models.

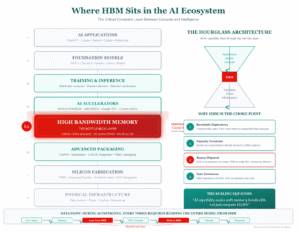

Here’s the part most people miss. AI-ready compute is an energy, cooling, and network problem first—and a software problem second. Nigeria is starting to connect those dots.

The Actual Move

- Investors are backing new data centers in Lagos and beyond. Bloomberg and others note hundreds of millions flowing, with aggregate pipelines near $1 billion.

- Operators are retrofitting for AI racks. Schneider projects a structural shift in design and capacity planning.

- Government is codifying the stack. Nigeria’s National AI Strategy explicitly calls for accelerated compute, model stacks, and modern data infrastructure.

- Ecosystem leaders are pushing accessibility. Microsoft highlights the path from isolated AI wins to a nationwide AI economy.

- Analysts tie today’s buildout to yesterday’s momentum. A long, non-AI colocation wave provides the real estate, procedures, and playbooks AI needs next.

“So if Nigeria ever becomes part of the AI training map, this decade of colocation investment will be a useful preface.”

“Schneider Electric is urging Nigerian data centre operators… to become AI-ready.”

“Nigeria is drawing millions of dollars into new data centers… propelled by the online habits of its young population.”

“The current era of AI requires modern data centres with accelerated computing.”

“Nigeria is emerging as a major hub… attracting nearly $1 billion in investments.”

The Why Behind the Move

Zoom out and the pattern becomes obvious. Compute is globalizing. Capacity is moving closer to data, talent, and demand. Nigeria sits at that intersection.

• Model

AI infra economics reward power access, land, and cooling mastery. Nigeria’s strategy aligns with building GPU-dense, energy-aware facilities that can sell training and inference capacity.

• Traction

Consumer internet growth fuels baseline utilization. That underwrites capex. As AI workloads ramp, operators can layer in higher-yield GPU racks.

• Valuation / Funding

Billion-dollar pipelines are credible when backed by steady colo demand plus AI upside. Capital looks for markets with both growth and cost arbitrage.

• Distribution

Local compute reduces latency and data egress. It also enables compliance for sensitive sectors like finance, health, and public services.

• Partnerships & Ecosystem Fit

Policy, OEMs, integrators, and cloud partners must align. Schneider-style retrofits, cloud on-ramps, and public-sector demand can de-risk long paybacks.

• Timing

Training costs are spiking globally. Tooling is getting cheaper regionally. This creates a window where Nigeria can offer cost-efficient capacity and proximity to African data.

• Competitive Dynamics

South Africa has legacy scale. Other African hubs are rising. Nigeria’s edge is demand density and policy momentum—if operators solve power and uptime.

• Strategic Risks

- Power reliability and energy costs

- Cooling and grid constraints for GPU thermals

- Skills pipeline for operating AI-grade facilities

- Policy execution and land/permitting friction

“It’s well recognised that Nigeria is already producing AI innovation. The focus now must be on making the technology widely accessible across the country.”

What Builders Should Notice

- Compute arbitrage is real. Follow power, not headlines.

- Colocation is the on-ramp. AI racks demand different design and OPEX discipline.

- Policy alignment compounds advantages. Strategy documents that name GPUs matter.

- Partnerships beat solo scaling. OEMs, integrators, and cloud on-ramps de-risk builds.

- Train near your data, serve near your users. Latency and data locality win deals.

Buildloop reflection

Every market shift begins with an infrastructure choice.

Sources

- TechCabal — Nigeria’s next big export isn’t oil, it’s AI computing power

- Notadeepdive — Nigeria’s (Non-AI) Data Centre Wave

- BusinessDay — Schneider Electric warns Nigeria’s data centres must become AI-ready

- Bloomberg — AI Boom Sparks Billion-Dollar Data Center Race in Nigeria

- African Diaspora International (Facebook) — Africa is quietly building one of the most exciting tech ecosystems

- NCAIR / NITDA — National Artificial Intelligence Strategy- 19092025

- The Electricity Hub — Schneider Urges Nigeria to Upgrade Data Centres for Effective AI Deployment

- Creative Tech Africa — OpenAI Code Red: Africa’s 2025 AI Shift Guide

- Microsoft News (EMEA) — How Nigeria can progress from pockets of AI innovation to a thriving AI economy

- Sputnik Africa — Nigeria’s AI Boom Ignites Multi-Billion Investment Surge in Data Centers