What Changed and Why It Matters

AI funding and adoption crossed a line. The center of gravity is moving from frontier models to narrow, data-rich workflows where real business value lives.

“In Q2 2024, 49% of all venture capital went to artificial intelligence and machine learning startups, up from 29% in Q2 2022.” — Contrary Research

“For all the fears of over-investment, AI is spreading across enterprises at a pace with no precedent in modern software history.” — Menlo Ventures

Zoom out and the pattern becomes obvious: the infrastructure wave is stabilizing; the application wave is specializing. The internet’s long-tail dynamic now applies to AI. Niche markets that were “too small” for traditional software economics are suddenly viable.

“AI will open new markets previously deemed too ‘small’ to support a large vertical SaaS company.” — a16z

“This graph explains why the internet is so powerful… It’s called The Long Tail.” — LinkedIn

Here’s the part most people miss: as model quality converges, advantage moves to distribution, proprietary data, and workflow depth—especially in verticals with messy, high-friction tasks.

The Actual Move

This isn’t one company’s launch. It’s an ecosystem shift driven by three observable moves:

- Vertical SaaS goes “AI inside”: Incumbents and new entrants embed copilots, automation, and decision support into existing systems of record. This expands TAM into previously uneconomic niches (micro-specialties, long-tail services, regional compliance workflows).

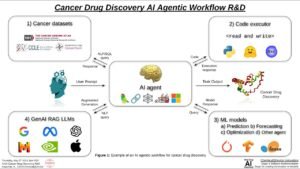

- Model-agnostic, workflow-first architecture: Winning stacks orchestrate multiple models, add retrieval over proprietary data, enforce structure, and keep humans in the loop for trust and auditability.

- Capital concentration + survival-of-the-focused: Funding pours into infra leaders and breakout apps while a large tail of “wrapper” apps faces consolidation.

“Wrappers are the API’s growth engine… Kill the wrappers, and OpenAI loses reach and revenue.” — Medium

“The AI industry currently produces new startups in something that is probably best described as a Cambrian explosion.” — Innospective

The macro backdrop supports it. The last five years saw a $100B+ surge in AI-related startup investment, with enterprises now shifting from pilots to platform adoption.

“AI completely revolutionized the global startup ecosystem in just five years: $100+ billion funding surge.” — The Percolator (Substack)

The Why Behind the Move

• Model

Foundational models are converging in quality for many tasks. The moat isn’t the model. It’s the data, distribution, and depth of the workflow. Smart teams pick best-for-task models, optimize latency and cost, and build swap-ability by design.

• Traction

The fastest adoption happens where ROI is measured in dollars and minutes—claims processing, underwriting assist, revenue-cycle sweeps, compliance checks, procurement triage. Clear KPIs (time-to-close, error rate, throughput) unlock budget.

• Valuation / Funding

Investors are rewarding durable gross margins and efficient growth over raw usage. Infra and category-defining apps still command premiums; generalist wrappers don’t. Expect downshifts for me-too copilots and up-rounds for verticals with proprietary data and retention.

• Distribution

Industry-native channels beat generic PLG. Integration with the system of record, marketplace placement, and partner-led co-sell drive trust—and accelerate security reviews. Bottom-up usage works best when paired with executive-level ROI proof.

• Partnerships & Ecosystem Fit

Model providers, clouds, and incumbents want usage and stickiness. Smart founders trade early integrations and co-marketing for distribution, while keeping optionality on models and metadata control.

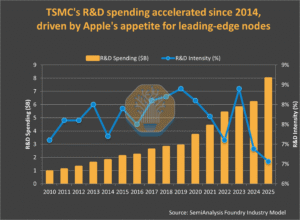

• Timing

Post-2024, the stack matured: better evals, cheaper inference, enterprise security, and governance primitives. Budgets unlocked as CFOs saw real unit economics from automation and augmented workflows.

• Competitive Dynamics

Incumbents are bundling AI into suites. Open-source models are “good enough” for many jobs. Hyperscalers push vertically flavored offerings. Niche startups win by owning edge-case workflows and data flywheels that generalists ignore.

• Strategic Risks

API dependency and upstream model changes can break assumptions. Data rights, privacy, and auditability are non-negotiable in regulated industries. “Wrapper risk” is real when platforms ship native features—unless you own the workflow, data, and distribution.

What Builders Should Notice

- Pick a painful, frequent, auditable workflow—then own it end-to-end.

- Your moat is data + distribution. Integrate deeply with the system of record.

- Be model-agnostic. Design for swap-ability, observability, and eval drift.

- Sell ROI, not magic. Instrument dollars saved, revenue lifted, risks reduced.

- Build trust primitives early: human-in-the-loop, traceability, permissions, SOC2.

Buildloop reflection

Niche is a strategy. In AI, it’s also a moat.

Sources

- Contrary Research — Deep Dive: The Long Tail of AI

- Medium — 99% of AI Startups Will Be Dead by 2026 — Here’s Why

- Substack (The Percolator) — How AI has Transformed the Startup Landscape – The Percolator

- Innospective — What does the AI startup of the future look like? Lessons from the SaaS boom

- LinkedIn — The Long Tail: How the Internet Empowers Niche Markets

- Menlo Ventures — 2025: The State of Generative AI in the Enterprise

- Andreessen Horowitz — “AI Inside” Opens New Markets for Vertical SaaS

- Bessemer Venture Partners — The State of AI 2025

- Reddit — AI startups are at the center of a lot of hype right now and …