What Changed and Why It Matters

Nigeria is building AI software at home, but most training still happens abroad. The bottleneck is compute. A wave of data center plans, GPU access initiatives, and policy proposals aims to change that.

Bloomberg frames a billion‑dollar race into Nigerian data centers, powered by a young, online population and rising AI demand. Industry voices argue that GPUs—not just software—will define who captures value. Others warn Nigeria still lacks “AI‑ready” capacity: power, cooling, interconnects, and the payment rails that enable real usage.

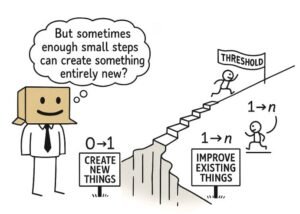

Compute is the new export. Countries that host it will host the value chain.

Here’s the part most people miss: the model work follows the machines. Talent goes where training is cheap and fast. If compute remains offshore, so does the economic upside.

The Actual Move

Nigeria’s ecosystem is pushing on several fronts at once:

- Data center buildout: Reports describe a fast‑forming, billion‑dollar race to expand colocation and cloud capacity for AI workloads in Nigeria.

- GPU access initiatives: Builders highlight efforts to stand up local GPU capability—some even exploring domestically produced hardware and development finance interest to fund it.

- Local billing + regional clouds: New infrastructure providers are letting African users spin up GPUs with local mobile‑money billing. That solves a real adoption barrier for startups without global cards or USD accounts.

- Policy and diaspora programs: Proposals include a dedicated AI/Emerging Tech desk to formalize partnerships between Nigerian AI experts abroad and local institutions, converting diaspora expertise into in‑country capacity.

- Market narrative shift: Tech media positions Nigeria’s next major export as AI computing power—not just talent or software—if the infrastructure lands locally.

- Reality checks: Experts caution that many facilities still aren’t AI‑ready. Power reliability, high‑density cooling, and network interconnects remain gaps. Microsoft’s regional analysis echoes the need to move from isolated wins to broad access.

- Regional competition: Ghana is also courting major capital for an AI and tech hub. The race for Africa’s compute center of gravity is open.

Infrastructure without local payment rails is shelfware. Adoption starts with how people pay.

The Why Behind the Move

The strategy is straightforward: host the GPUs, host the value.

• Model

Nigeria’s AI value chain is constrained by offshore training and inference. Local GPU hubs shift the cost curve, reduce latency, and keep data and economics onshore.

• Traction

Youthful, online demand is real. Early GPU cloud experiments with mobile‑money billing indicate product‑market fit mechanics: make compute accessible, and builders will use it.

• Valuation / Funding

Data centers and GPUs are capital‑intensive. Development finance interest and public‑private partnerships can de‑risk long‑dated infrastructure. The upside: recurring, dollar‑linked compute revenue.

• Distribution

Local payments, local support, and low‑latency access are stronger moats than specs. Distribution—who can make GPUs usable for thousands of small teams—will decide winners.

• Partnerships & Ecosystem Fit

Government desks that plug diaspora expertise into universities, startups, and agencies can accelerate capacity. Cloud providers, ISPs, and power producers need tight integration to deliver reliable AI‑ready SLAs.

• Timing

Global AI demand is compounding. Countries that land capacity in the next 12–24 months will set their regional position for the decade.

• Competitive Dynamics

South Africa has scale data centers; Ghana is signaling big moves; hyperscalers are circling. Nigeria’s advantage is demand density and talent—if it matches that with stable power and GPUs.

• Strategic Risks

- Power costs and grid stability

- Cooling for high‑density racks in hot climates

- FX volatility on imported hardware

- Overreliance on foreign suppliers for critical components

- Policy uncertainty that slows permits and interconnects

Talent follows compute. Not the other way around.

What Builders Should Notice

- Build for access, not just scale: local billing, local support, reliable SLAs.

- Distribution beats hardware: who onboards the most teams wins the usage flywheel.

- Design for power first: energy is half your P&L in AI infrastructure.

- Partner early: telcos, campuses, and diaspora networks accelerate trust and demand.

- Measure outcomes: latency, uptime, and cost per trained token—not vanity capacity.

Buildloop reflection

The countries that win AI won’t just write the code—they’ll host the compute.

Sources

- Bloomberg — AI Boom Sparks Billion-Dollar Data Center Race in Nigeria

- LinkedIn (TechCabal) — Nigeria’s AI leap: Alex Tsado’s mission to make high …

- BusinessDay — The cost to keep up with the AI boom in Nigeria, Africa

- TechCabal — Nigeria’s next big export isn’t oil, it’s AI computing power

- Forbes Africa — How Africa Is Building Its Own AI From The Ground Up

- Medium — Bridging the AI Divide: Building Africa’s Future in the Age of …

- Business Beat 24 — Africa Builds Its Own AI Future with New Infrastructure Cohort

- Facebook — Africa’s ai acceleration hits unprecedented levels

- Microsoft Source — How Nigeria can progress from pockets of AI innovation to …

- The Sun Nigeria — Nigeria at risk: no AI-ready data centres, experts warn