What Changed and Why It Matters

Crypto investors are backing AI that does real work. The new signal: a cluster of $15M rounds aimed at research, data, and compliance.

Surf raised $15M to scale an AI model built for digital assets. A16z crypto funded a $15M marketplace for licensed AI training data. CFO data governance, testing automation, and onboarding AI also saw $15M checks.

The pattern is clear. Capital is shifting from speculative crypto bets to applied AI with measurable utility.

“Surf raises $15 million to scale the first AI model purpose-built for digital assets.”

“Poseidon raised $15 million in seed funding from a16z crypto to create a decentralized marketplace for legally licensed AI training data.”

Here’s the part most people miss. The moat isn’t the model. It’s the data, workflow integration, and trust.

The Actual Move

- Surf secured $15M led by Pantera Capital to expand its digital-asset AI engine and launch Surf 2.0. The product targets traders, researchers, and investors who need timely, structured crypto insights.

“Funding will develop Surf 2.0, to serve the high demand of crypto insights from crypto traders, researchers and investors.”

- A16z crypto backed Poseidon with $15M to build a decentralized marketplace for legally licensed AI training data. It aims to solve the rights and provenance bottleneck for model developers.

- Safebooks AI raised $15M seed funding to grow a financial data governance platform for enterprise CFO teams. This is AI infrastructure for trust, controls, and auditability.

“Safebooks AI raises $15M seed funding to expand its financial data governance platform built for enterprise CFO teams.”

- OnRamp landed $15M to push AI-driven customer engagement and onboarding while moving upmarket.

“Funding powers the next phase of growth with AI-driven customer engagement, onboarding innovation, and expansion upmarket.”

- Momentic raised $15M Series A to automate software testing with AI. It’s another sign that $15M is now the default “serious build” check size for applied AI.

- AInvest notes a structural shift: domain-specific AI is institutionalizing crypto research.

“By 2025, domain-specific AI tools like Surf have transformed crypto into a legitimate institutional asset class through data-driven insights.”

- The broader context is a move away from speculative cycles to durable utility.

“The dotcom frenzy saw billions flow into speculative internet startups, and the cryptocurrency boom attracted its own wave of venture capital.”

The Why Behind the Move

• Model

Specialized beats general. Crypto-native AI models and pipelines are tuned to on-chain signals, market microstructure, and domain lexicons. General LLMs struggle with accuracy and latency here.

• Traction

Demand is practical: research accuracy, decision speed, compliance coverage, and CFO-grade governance. Traders and institutions want structured outputs they can trust.

• Valuation / Funding

$15M sits in the sweet spot. It funds data pipelines, fine-tuning, enterprise integrations, and go-to-market without forcing premature scaling. It also buys time to prove real metrics.

• Distribution

The winners plug into existing workflows: trading terminals, compliance dashboards, ERP and FP&A stacks, and developer CI pipelines. Distribution often beats model quality.

• Partnerships & Ecosystem Fit

Pantera and a16z bring exchanges, data owners, and institutional users. Data rights and licensing partnerships will define defensibility for research AI and training-data markets.

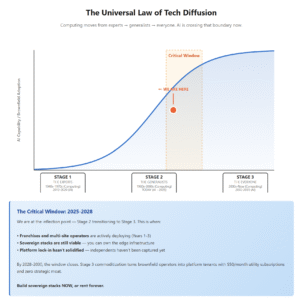

• Timing

AI training data has become a legal and economic bottleneck. Crypto’s 2025 cycle and tightening regulation raise the premium on licensed data, auditability, and explainable outputs.

• Competitive Dynamics

Incumbents like Bloomberg, Chainalysis, TRM, Kaiko, and Messari own distribution. New entrants must differentiate on freshness of data, explainability, and task-level ROI.

• Strategic Risks

- Regulatory shifts on data rights and compliance

- Hallucination risk in high-stakes research

- Dependency on third-party data and exchange APIs

- GTM friction versus entrenched vendor contracts

What Builders Should Notice

- Specialization compounds. Domain-tuned AI wins when accuracy and latency matter.

- Data rights are a moat. Licensed, traceable data will beat scrapes.

- Distribution first. Ship into existing tools and daily workflows.

- $15M is the “utility check.” Use it to prove ROI, not vanity metrics.

- Trust sells. Governance, audit trails, and explainability close enterprise deals.

Buildloop reflection

“The moat isn’t the model. It’s the data, the workflow, and the trust.”

Sources

- Ventureburn — Surf Raises $15M in Funding

- PR Newswire — Surf Raises $15M to Scale the First AI Model Purpose-Built for Digital Assets

- AInvest — The Rise of Specialized AI in Crypto Research: Why Surf is Worth Watching for Institutional Investors

- Yahoo Finance — OnRamp Secures $15M to Accelerate Growth and Scale AI

- Token Metrics — Top 5 Long-Term Crypto Picks for the 2025 Bull Market

- Benzatine — Momentic raises $15M to automate software testing

- LinkedIn (Techstars) — TransCrypts raises $15M for blockchain-based verification

- Ventureburn — Safebooks AI Raises $15 Million

- Blocmates — Crypto Fundraising: Who Raised How Much This Week?

- Reuters — The dotcom frenzy saw billions flow into speculative internet startups…