What Changed and Why It Matters

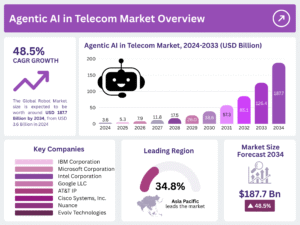

AI funding is accelerating as public market signals turn cautious. Reuters notes rising bubble concerns with valuation gauges flashing hotter than the dot-com era. NPR highlights hundreds of billions pouring into AI data centers. Goldman Sachs (via Business Insider) warns the current frenzy could rhyme with 2000.

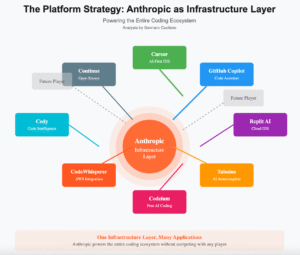

Here’s the part most people miss: rounds aren’t just getting bigger—they’re stacking. Founders are raising multiple financings in tight sequence to lock GPUs, power, and distribution. At the same time, NBC reports circular deals across Big AI—money looping among model labs, chipmakers, and hyperscalers—risking a mirage of growth.

“The market is pricing AI as inevitability while the inputs—compute, power, and customers—are still rationed.”

Why it matters: stacked rounds can be an operating necessity in a compute-constrained market. But if revenue and financing become too circular, a pullback could cascade quickly across the stack.

The Actual Move

Across the ecosystem, companies are:

- Stacking rounds: raising new equity within months to secure scarce GPUs and power contracts.

- Using vendor financing and prepayments: committing capital upfront for H100/B200/MI300 supply and colocated capacity.

- Leaning on circular deals: buying chips and services from partners who are also investors or customers (NBC’s reporting on Big AI’s interconnected flows).

- Concentrating value: a few leaders capture most of the valuation premium (SVB-linked 2025 data via Unlisted Intel).

- Riding hyperscaler CapEx: hyperscaler spending acts like demand scaffolding, pulling forward valuations.

Public markets are now blinking yellow. Reuters flags the Buffett Indicator above dot-com levels. Yahoo Finance cites a prominent bull growing worried about an AI-driven bubble. Discovery Alert aggregates bank warnings of 10–20% corrections as some multiples stretch to extreme levels.

“Stacked rounds are a rational response to scarcity—until they amplify correlated risk.”

The Why Behind the Move

• Model

Foundation model economics are front-loaded. Training cycles demand massive cash to secure compute and data center slots. Stacked rounds pull future capital forward to de-risk execution windows.

• Traction

Early traction can be real yet circular. Revenue from ecosystem partners or credits can overstate independent demand. Builders must separate durable usage from subsidized usage.

• Valuation / Funding

Valuations are clustering at the top. SVB-linked data suggests value concentration in a handful of leaders, raising late-stage FOMO and compressing time between rounds.

“When supply is rationed, pricing drifts from fundamentals to access.”

• Distribution

Distribution often rides hyperscaler channels, marketplaces, and model partnerships. Great for reach; risky if a single channel tightens incentives or changes terms.

• Partnerships & Ecosystem Fit

Partnerships double as financing. Prepaid GPU agreements, cloud commits, and co-selling can unlock capacity—and mask dependency. NBC notes rising reliance on circular deals among AI majors.

• Timing

Power and GPU queues make timing a strategy. Slip a quarter, lose a year. Stacked rounds buy calendar certainty in a scarce supply chain.

• Competitive Dynamics

Leaders weaponize balance sheets to lock compute and power. Followers stack rounds just to stay in line, not leap ahead. This favors capital-rich incumbents.

• Strategic Risks

- Correlated counterparties: the same few firms are buyers, sellers, and investors.

- Pullback exposure: a 10–20% market correction could compress follow-on rounds quickly.

- Overbuild risk: NPR highlights massive data center spend; if demand lags, assets go idle.

- Multiple risk: Business Insider’s Goldman note flags dot-com echoes if growth underdelivers.

What Builders Should Notice

- Raise against bottlenecks, not headlines. Tie capital to compute, power, and distribution.

- Separate circular revenue from customer demand. Report both clearly.

- Structure resilience. Diversify compute vendors, regions, and channels.

- Milestone your financings. Use tranche triggers tied to capacity online and unit economics.

- Build offtake-backed financing. Anchor big commits with real downstream contracts.

“Focus compounds faster than scale. In AI, capacity is focus.”

Buildloop reflection

“Capital is not the moat. Converting scarcity into durable advantage is.”

Sources

- Reuters — AI rally shows cracks as investors question risks

- Forbes — It’s Not Just An AI Bubble. Here’s Everything At Risk

- Yahoo Finance — This chart shows the risk of an AI bubble is growing, says a …

- NPR — As AI companies continue to invest heavily, concerns about …

- Business Insider — Stock Market Bubble: 5 Warnings From Dot-Com Boom to …

- Unlisted Intel — AI Valuations 2025: Scale, Concentration, and Bubble Risk

- LinkedIn — AI bubble signs: unicorns, circular financing, debt, stacked …

- Discovery Alert — AI Bubble Warnings: Expert Predictions & Market Risks

- NBC News — Big AI’s reliance on circular deals is raising fears of a bubble