What Changed and Why It Matters

AI is now the center of the venture market. In Q1 2025, AI startups raised $73.1B and took 58% of all VC dollars. Seed-stage AI valuations ran 42% higher than non‑AI peers in 2024.

Valuations aren’t just up. They’re moving fast. Some leaders doubled in months. OpenAI’s private valuation has been reported at ~$300B after a $40B round, with other reports implying it climbed another ~$200B within six months.

Here’s the important shift: rounds are stacking, timelines are compressing, and governance is adjusting on the fly. Yet Europe is already seeing more down rounds. The signal: capital abundance and correction risk are now coexisting.

“In the first quarter of 2025, AI startups raised $73.1 billion globally, accounting for 57.9% of all venture capital funding.”

“Seed valuations were 42% higher for AI startups… the median pre-money hit $17.9 million in 2024.”

The Actual Move

This cycle isn’t about a single company. It’s an ecosystem executing the same playbook at higher speed.

- Mega-rounds concentrated in foundation models and agentic platforms. Dozens of U.S. AI startups raised $100M+ rounds in 2025, with money shifting from text-only to multimodal and agentic systems.

- Valuations re-rated in months. Reports put OpenAI at ~$300B after adding $40B, with others suggesting implied valuations pressing toward ~$500B. Several breakout apps are posting near–$100M ARR inside a year, enabling 10–50x step-ups.

- Governance is changing. As late-stage money and secondaries flow in, unicorn boards are reshuffling to meet growth, liquidity, and risk demands.

- Europe is flashing a caution light. Down rounds are rising even as headline valuations hit records.

“Foundation models and agentic platforms took home the biggest portion of mega-round dollars.”

“Fal.ai’s valuation rose from ~$80M to ~$4B in 12 months as annualized revenue neared ~$95M.”

The Why Behind the Move

The market is rewarding speed, proof, and position. But the bar is rising.

• Model

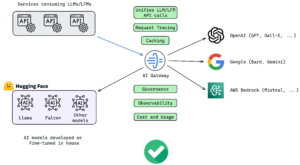

Foundation models and agentic platforms attract the largest checks. Investors are leaning into stack ownership and into products moving from text to vision and multimodal.

• Traction

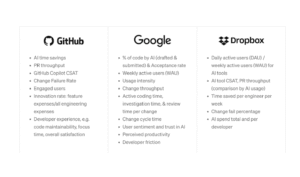

Real revenue now matters. Breakouts hitting ~$100M ARR in months are rare but reset expectations for everyone else.

• Valuation / Funding

High-velocity rounds preempt competition and talent flight. Crossover capital and secondaries blur PE/VC lines. Multiple sources show AI valuations doubling in short windows, but that comes with a future re-rating risk.

• Distribution

Winners convert model advantage into channels: embedded workflows, enterprise contracts, and developer ecosystems. Here’s the part most people miss: distribution creates compounding data advantages.

• Partnerships & Ecosystem Fit

Agentic platforms tie into existing tools and APIs. The value is orchestration, not standalone novelty.

• Timing

The 2025 window is open. Budgets are forming, and infra has matured. Fast followers can still win if they show ROI quickly.

• Competitive Dynamics

Capital is an arms race. But moats form around distribution, switching costs, and trust—not just models.

• Strategic Risks

Europe’s uptick in down rounds signals a fragile floor. Overhang from stacked valuations, governance strain from rapid board shifts, and gaps between AI promise and customer ROI can all bite.

“AI‑enhance your product aggressively so you can access VC or PE in 12–24 months—with better metrics.”

What Builders Should Notice

- Preemptive rounds work only if metrics support them. Ship ROI, not demos.

- Distribution is the real moat. Win channels, integrations, and default status.

- Treat valuation as a liability. Plan for the next round’s reality, not today’s headline.

- Agents need workflows. Build around jobs-to-be-done, not model novelty.

- Prepare for secondaries and governance early. Board design is a product decision.

Buildloop reflection

“AI rewards speed—only when it compounds into trust.”

Sources

- Crunchbase News — In The Space Of Months, AI Funding Boom Adds More …

- Sherwood News — AI startups’ high-velocity valuations are shooting sky-high

- Forbes — How PE And VC Collapsed Into One Battlefield

- Reuters — AI startup valuations raise bubble fears as funding surges

- PitchBook News — AI down rounds rise as questions grow over Europe’s bubble

- LinkedIn — Which AI app companies reached $100M ARR in 6 months?

- Substack — New SaaStr AI LIVE with Jason Lemkin: VC Funding in the AI …

- FindArticles — 49 U.S. AI startups raised $100M or more in 2025 – FindArticles

- Carta — Five charts showing how AI is dominating the venture …